Craft a Powerful Business Plan:Â Your business prepare really should provide an extensive overview of one's business, which includes its mission, vision, and targets. It also needs to element how the loan will add to acquiring these goals.

Blanket lien: Also called a Uniform Commercial Code (UCC) submitting, this gives lenders the legal correct to seize your business assets if you default on a loan. Lenders may perhaps call for this By itself or Along with Yet another sort of collateral to make certain These are guarded.

Automate Payments: Create automated loan payments to ensure well timed repayments and stay away from late fees. Automating payments could also enable regulate money flow and decrease administrative overhead.

Small-business grants. In order to stay clear of credit card debt completely, you may perhaps consider applying for small-business grants. Grants present free of charge access to cash that don’t must be repaid. Even though grant applications is usually time-consuming and competitive, the method will be worth it if you may get funding.

Leverage Pre-Qualification Applications: Numerous online platforms give pre-qualification resources that permit you to gauge your eligibility for different loans devoid of impacting your credit rating. Use these equipment to slender down your options and identify lenders who are more likely to approve your software.

If you need to finance working day-to-day fees, business credit cards are another option to contemplate. Eligibility conditions is generally less stringent than classic financing, plus you are able to get paid bonus and business journey benefits together the best way.

Research and compare several selections to discover the very best suit for you. You’ll want to look for a lender whose specifications you could satisfy and 1 who offers the kind of credit line you would like.

If a secured business loan isn’t appropriate in your business, take into account these other types of financing:

You’ll want to compare rates and terms on a number of loan offers to discover the greatest pne to your business. Am i able to have a startup business line of credit?

A lot more Regular repayment. With terrible credit, you might need to repay what you borrow far more quickly, like on the weekly or biweekly basis.

Typically, the money are deposited on exactly the same day or inside a handful of business times. In comparison, an SBA or traditional lender loan is more time-consuming, with funding times Long lasting nearly 90 times.

Kapitus’s borrowers often had optimistic encounters Along with the lender, noting the short and successful funding approach and also the useful how to get an unsecured business loan customer support. Nevertheless, there were some buyers who had worries with regards to the high interest costs and fees.

Kapitus’s most line of credit is more substantial than quite a few competition’, making it a great choice for businesses that have to have access to large quantities of capital. The lender also offers up coming-working day funding.

Home loan calculatorDown payment calculatorHow Substantially home am i able to pay for calculatorClosing costs calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculator

Edward Furlong Then & Now!

Edward Furlong Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Barbi Benton Then & Now!

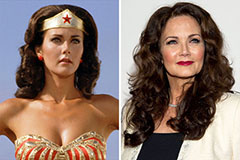

Barbi Benton Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!